The post 9 Affordable Meals I’ve Been Loving appeared first on Mixed Up Money.

]]>Meatballs, Mashed Potatoes, and Green Beans – $8.74 per serving

This meal is a trifecta of comfort, convenience, and taste. I buy premade meatballs because, let’s be honest, who has the time to make them from scratch? Adding Boursin cheese to the mashed potatoes makes them irresistibly garlicky and creamy. Frozen green beans complete the plate, offering a quick and nutritious side. This dish is easy to prepare, absolutely delicious, and perfect for a cozy night in. No recipe for this one! Just vibes.

Air Fryer S’mores – $0.50 per serving

Who said you need a campfire to enjoy s’mores? These air fryer s’mores are a game-changer. They’re incredibly easy to make, and you get to skip the campfire smoke smell. The graham cracker, chocolate, and marshmallow combo is always a hit, and these treats come out perfectly gooey and delicious every time. At just 50 cents per serving, they’re a sweet treat that won’t dent your wallet. Another one that doesn’t require a recipe! Keep an eye on them; they don’t take long in the air fryer! Less than 2 minutes does the trick.

Lasagna Soup – $3.50 per serving

This vegetarian lasagna soup is a bowl of comfort. It’s simple to make and packed with all the flavours of traditional lasagna without the fuss. Serve it with garlic bread on the side for an extra indulgence. It’s hearty, satisfying, and perfect for a cozy dinner. Plus, it’s a great way to enjoy lasagna flavours without the effort of layering and baking.

Chickpea Pot Pie – $2.60 per serving

I couldn’t believe how easy this chickpea pot pie was to make! The biscuits cook beautifully on top, creating a delightful crust over the savoury filling. It’s so delicious and a definite 10/10 in my book. Next time, I’ll add more spice to kick it up a notch, but it’s fantastic. This dish is hearty, comforting, and perfect for those nights when you need a warm, home-cooked meal.

Ground Beef and Broccoli – $4.37 per serving

This ground beef and broccoli dish is incredibly filling and easy to whip up. It’s a great option for a quick weeknight dinner that doesn’t skimp on flavour. The beef is savoury, and the broccoli adds a nice crunch and freshness. It’s a simple, no-fuss meal that always satisfies.

Beef Dip and Sweet Potato Fries – $5.99 per serving

I bought the beef from Costco to make this meal even easier. The au jus dip package makes the beef dip perfectly flavorful, and pairing it with sweet potato fries is a match made in heaven. Fresh buns from the bakery elevate the whole experience, making it taste even better than a restaurant meal. It’s incredibly easy to prepare and absolutely delicious. No recipe for this! I added cheese and butter, baked them for 10 minutes, and made the au jus on the stove.

Black Bean Enchiladas – $2.83 per serving

I’m obsessed with these black bean enchiladas! They’re so yummy and filling and have just the right amount of spice. As someone who loves a bit of heat, I know these enchiladas hit the spot. They’re also incredibly budget-friendly and perfect for a satisfying dinner.

Thai Chop Salad – $2.65 per serving

This Thai chop salad is a fantastic potluck dish because it’s vegan, making it a safe option for everyone. The tofu, cooked perfectly in the air fryer, adds a great texture, and the sauce is simply delicious. I love the account I got this recipe from; she always has creative ideas. This salad is fresh, flavorful, and perfect for any gathering.

Thai Beef Rolls – $3.50 per serving

These Thai beef rolls are super yummy and versatile. You can add more toppings than the recipe calls for, but the spices make the beef taste amazing on its own. They’re a great way to enjoy a flavorful meal that’s easy to prepare and satisfying. Perfect for a light dinner or a tasty appetizer.

These meals have brought a lot of joy to my table recently. They’re affordable, easy to prepare, and packed with flavour. I hope they inspire you to try something new and delicious without spending a fortune. Happy cooking!

The post 9 Affordable Meals I’ve Been Loving appeared first on Mixed Up Money.

]]>The post The Financial Perks of Being In An Equal Relationship appeared first on Mixed Up Money.

]]>Life is a lot easier with a partner who is on board to split all of life’s responsibilities

People hate to admit their privilege. It’s a hard pill to swallow. To have to admit that some aspects of your life have given you an easier path than others. But ignoring or denying that you have had an easier time in your life just based on your skin colour, social class or gender isn’t going to help anything. The reality is that understanding and appreciating others challenges is the only way you can truly learn.

One privilege that a lot of us who voice our financial successes forget to mention is the perk of being in a relationship or having a partner who can help to support and supplement our incomes.

Having a partner that can help support or reduce financial stressors in our day-to-day lives can make money seem less tricky and more manageable. Because money can be tricky — especially if you have to navigate your many financial goals alone. But that’s just me pointing out the already obvious reasoning behind you reading a financial blog — because it’s not always the straightforward textbook answer you’re looking for. I mean, DUH MUCH? Our finances are complex and unique to each and every one of us.

But on the real — in just two short weeks, my husband and I will be celebrating our second wedding anniversary hiking in the beautiful Albertan mountains. We won’t be doing anything luxury, like buying one another gifts or celebrating with an expensive dinner out. Luckily, we’ll already be in the town we were married to attend another wedding.

We aren’t a young married couple that spends money just to spend money. Although I’m not sure many young married couples are that way these days. Pretty sure we’re all just trying to survive the financial burdens that society puts on us like maybe homeownership, potentially raising a family and sometimes pretending we are capable of navigating through the world of saving.

My husband and I realized something when our baby was born two months ago

Life is a lot easier with a significant other who is on board to split all of lives responsibilities. I mean, we started to discuss how much we respect single parents, individuals who buy property on their own, couples who have partners that are unsupportive and really all single people in general. Until having to take care of another human being, we had forgotten how much of an advantage and privilege it is to be in a relationship with someone who is on your team.

Now, before I write another paragraph that makes it seem like I’m bragging or raving about how much better my life is because I have a partner, that’s not where I’m going. But where I am going is down the path that many people who are in relationships need to remember when it comes to their financial situation.

Having a partner is extremely advantageous for your finances — IF you consider one another equals

The amount of parenting forums I’ve entered (yes, willingly) in the past two months is unprecedented. Like, no one should spend that much time browsing Baby Centre threads just for the hell of it. But hey, I had a lot of time while breastfeeding at 3:00 AM so I chose my readings purely based on what would keep me awake, informed about newborn doo-doo, and entertained. Yes, now that I’m a mom I use the term “doo-doo” in my blog posts. It’s super profesh.

I read an obscene amount of content where people in committed relationships were questioning whether others had a significant other who was disinterested in providing as much support to their partner as they’d hoped. The primary reason for their lack of support was because they felt they were contributing financially, so all other areas of life were off the table.

First of all, I’ll point out the obvious by saying that no one person in a relationship is responsible for one area of livelihood. If you are the provider while your significant other is on parental leave — I’m assuming you made that decision as a team. Therefore, holding something over the other person you agreed to partner up with is not fair. I mean, common sense you would think. But many of the comments replying to these threads were in similar situations, and it broke my heart.

How can you use being in a relationship to your financial advantage?

Live on one income

I know, I know. Who the hell wants to live on one 40k salary when you could live on two? Well, I’ll tell you who. The person who wants to save 40k in one year to benefit a large financial goal. If you can live modestly and somehow scrape by on one income for two individuals, you might as well try!

Work perks benefit everyone

Rather than pay for healthcare coverage through two salaries, go for the family option. Remember to do your research first (obvi), regarding who has better coverage and which one is more affordable because sometimes it’s still cheaper to do your own. However, it’s definitely worth a shot.

Tax season, honey

Joint tax returns can be great for relationships in which one partner earns a higher income and the other earns a more modest amount. Not only that, but you’ll only have to file one return. So, that’s like, the biggest benefit of them all.

Teamwork makes the dream work

Being in an equal financial relationship is like having a built-in accountability buddy. Not only can you keep each other on track with your financial goals and budget, but you can also boost rewards points on a joint credit card at an accelerated rate if you work as a team to chalk them up.

But listen — I know not every single one of you is in a relationship. Or maybe you are but are soon to be out of one. Because hey, it happens! Don’t worry. There are also financial benefits to being on your own.

How can you use being single to your financial advantage?

No trying to change anyone

It’s impossible to be in a successful partnership if the person you have chosen doesn’t have similar interests or hobbies. If you’re in love with the idea of building wealth and focusing on your financial future, you can focus on doing this without having to worry about appeasing anyone else or trying to convince them that no-name brand Fruit Loops taste the exact same as real Fruit Loops. Don’t @ me.

You’re the only one who can create debt

When you’re single as a pringle and not ready to mingle because you don’t need no man, no one else can come home one day and tell you that they bought a new car without informing you first. And oh, by the way — this debt is your debt, this debt is my debt, no wait that’s your debt, oh wait it’s my debt. Please tell me you get my Friends reference.

Being single can afford you the opportunity to control what large purchases you made. It can also help you to focus on paying off your credit card bills and student loan payments only.

No matter where you’re at in your financial life, the sooner you focus on how you can benefit from your significant other or your independent self, the sooner you’ll be able to get down to business with your money.

How do you talk about money in a relationship?

My course, ‘Oh F*ck, Are We Ready to Talk About Money,’ is perfect for couples to learn how to navigate a typically uncomfortable conversation. You and your partner have experienced enough uncomfortable firsts. So, let’s not put ourselves through that again with our money.

What does the ‘Oh F*ck, Are We Ready to Talk About Money’ course get you?

15 exercises to help you better understand each others’ financial situation

15 exercises to help you better understand each others’ financial situation

A 24-page printable workbook to use as you go through the course

A 24-page printable workbook to use as you go through the course

7 video lessons to guide you through the tougher conversations

7 video lessons to guide you through the tougher conversations

3 goal-setting tactics to help you plan your financial future together

3 goal-setting tactics to help you plan your financial future together

Quiz to help you identify the best way to manage your money

Quiz to help you identify the best way to manage your money

Excel spreadsheet to manage your monthly budget separately or together

Excel spreadsheet to manage your monthly budget separately or together

The post The Financial Perks of Being In An Equal Relationship appeared first on Mixed Up Money.

]]>The post 8 Affordable Ways to Celebrate the Holiday Season appeared first on Mixed Up Money.

]]>Your wallet will love these low-cost activities

This year has been a blur, and it’s crazy that we’re approaching the end of 2021 already. But, before we look to what the new year may hold, I’m very excited to be nearing the holidays, my favourite time of year. While the holidays should be a time of joy with loved ones, they can also be daunting. Fancy dinner parties, gift-giving, and family vacations can include a hefty price tag. All of these costs may diminish the fun because you’re stressing about how you’ll pay for everything. And, rightly so.

While the idea of not spending may feel like a damper on your celebrations, it doesn’t have to be. There are countless ways to get into the spirit that don’t pack such an expensive punch. So here are my favourite ways to celebrate the season that your friends, family, and wallet are sure to love.

#1. Looking at Christmas lights

One of my favourite free activities over the holiday season is seeing all the lights, either by just walking through my neighbourhood or going to an organized event. Often cities will set up light shows for residents to walk or drive through for free or at low cost. My family has a tradition of taking my grandparents through Toronto’s most decorated neighbourhoods each year, especially the famous Kringlewood in Rosedale with their over 50 inflatable Santas. Kids and adults are sure to love this one, and a little Bailey’s in your hot chocolate for the adventure is never a miss.

#2. Movie marathons

There isn’t anything quite like a snowy December night watching a holiday movie marathon with a hot cup of tea in your pyjamas. Although we are spoiled these days with unlimited options on streaming platforms, there’s nothing quite like watching whatever classics or cheesy Hallmark films are on cable that night. My childhood favourites are The Nightmare Before Christmas, The Polar Express, and Elf; of course, I’m no cotton-headed ninny muggins.

#3. Baking

When I think of my favourite part of the holidays, the food is undoubtedly top of mind, especially the drinks and desserts. Peppermint Mocha with a Gingerbread Loaf, anyone? Food is certainly the way to my heart and holiday-themed even more so. Some of my favourite dessert classics are gingerbread cookies, shortbread, and anything butterscotch or salted caramel. In addition, baking is a great date or family activity that can act as a thoughtful, low-cost holiday party gift. It is a win-win.

#4. Skating

Skating is a great way to get outside with the family and have a date night this winter at no cost. At least in Canada, public rinks are everywhere, and some have rental options if you don’t have any skates of your own. However, beware of your local social distancing rules as this may cause unwanted line-ups at busy times. We should also note that a hot drink always follows skating dates (at Starbucks). I don’t make the rules.

#5. Window shopping at the Christmas Market

Sometimes it’s the act of shopping that’s more fun than buying anything, and I often feel this way about local Christmas markets. They’re beautiful to visit, but most sell items at a premium due to the heavy foot traffic. However, they do provide great entertainment and will certainly help you get into the spirit this winter, along with getting a great Instagram photo-op.

#6. Arts and crafts

The holidays are an opportunity to try new hobbies that you may not have had time for during the year, like arts & crafts! Some ideas of seasonal crafts are make-your-own Christmas ornaments, cards, Hanukkah dreidels, or stockings. Of course, there’s nothing you can’t do with some glitter and a glue gun. Your cool creations can also make great homemade gifts for friends and family that they’re sure to love.

#7. Tobogganing

For all my non-Canadians, this is another word for sledding. Tobogganing can be a great winter activity, and who says you have to be a kid to enjoy it! If you don’t already have one, you can pick up a reasonably priced toboggan at your local Walmart or just do it old school with a large piece of cardboard that’s equally effective. Tobogganing with a few beverages in the perfect fun-filled winter activity for you and your group of friends, no cooler required.

#8. Family Game Night

When I think of celebrating the holidays, I mostly think of spending much-needed time with loved ones. My favourite holiday memories include playing days-long monopoly games with my cousins or playing card games with my grandma. This time of year is the perfect chance to dig out the old board games you grew up playing for some electronic-free family fun! Just be sure that your Christmas gifts are non-refundable because the competition can get fierce.

With the holidays just around the corner, I hope that these ideas help you get into the spirit of the season and hopefully alleviate some of the stress your holiday budget is feeling. Also, if you have any other fun family traditions that I didn’t mention on this list, be sure to let me know in the comments!

The post 8 Affordable Ways to Celebrate the Holiday Season appeared first on Mixed Up Money.

]]>The post How One Mom Managed Her Money in the Early 2000s appeared first on Mixed Up Money.

]]>Sarah interviews her mom about how money has changed

Travelling on the train with my mom on our first mother-daughter trip in years felt like the perfect time to pick her brain on her financial journey. I meant to do this interview for a while, as my mom was a big inspiration for me growing up. She managed our family’s finances while also working in the industry.

She always talked about the importance of being financially literate and was concerned that personal finances were not a part of our school curriculum. She helped me open my first bank account at seven years old and get my first credit card at eighteen.

My parents’ financial life is one that I hope to emulate. They grew up without a lot of money and worked hard to get to where they are today. They funded my college education, have paid off their mortgage in Toronto, and have both successfully retired with enough saved to continue to support their lifestyle. These are things that many of us hope to do one day.

So, as the family money manager, how did she do it? Does she regret anything along the way, like when she got into the real estate market? And, what advice would she give someone hoping to do the same? I made sure to ask all of these questions.

1. Have you ever been in debt?

Besides our mortgage, the only time was when I left school with a small student loan. In my last year of undergrad, I took out a $1,500 loan that I had to pay off. It didn’t take me long after I started working. Although it doesn’t seem like much now, that was an entire year’s worth of tuition back then! I was fortunate not to have more debt. I could afford education by working every summer with the Canadian government in Ottawa, where I’m from. Whatever I couldn’t afford, my parents would cover the difference to focus on my studies throughout the school year and not have to work. This helped me a lot.

2. When did you start investing, and how?

I started investing when I began working in the finance industry at 25. I started as an assistant bond trader without much prior experience at a mutual fund company. I was able to buy my companies funds without any management expenses. It was a great deal for me since it was cheap and easy to manage on my own. I didn’t get a financial advisor until I was 45 when our family’s finances got more complex. I would invest in my Registered Retirement Savings Plan (RRSP), as the Tax-Free Savings Account (TFSA) didn’t exist back then, and every year I would max out my contribution room.

3. Very few women are the money managers for the household, especially as baby boomers. How did you manage dad’s money? Did it affect your relationship dynamic?

Yes, I’ve always managed dad’s money. He’s never been very interested. Similarly, I would put all of his savings into an RRSP and buy my company’s mutual funds. The various income splitting strategies that exist today didn’t exist back then. What did exist was the use of a spousal RRSP like they have now. Since dad was still in school and working part-time, I would use some of my RRSP contribution room and contribute to a spousal RRSP under his name. This meant that we would have similar retirement savings and save on taxes as a family. It

never affected our relationship — he had his specialties, and I had mine. He was pretty happy to hand me the reigns. We treated all of our money as a pool, so it felt right that I would handle all the financial decisions.

4. In less than a year, you took on two major expenses – a child and buying your first home. How did you save up? Did you have to make any drastic lifestyle changes?

Our lifestyle has always been pretty frugal. We enjoy travelling, but otherwise, we’ve never cared much for material things. When we had our only child, I’d been in the workforce for over ten years. At that point, I was 36, and dad was 40. Although dad was still in school, we felt like it was time to start a family.

In terms of having a child, as that came first, we had researched and talked to friends, so nothing came as much of a shock. We had found a daycare that we liked and were comfortable with the costs. We also saved by using my parents for childcare the first few years, although we did pay them a small salary for their time. With saving for a house, we ended up using the Home Buyer’s Plan to borrow money from our RRSPs and took out the full amount at the time, which was about $40,000. The additional $20,000 of our down payment came from a savings account. We knew we were going to buy soon, so we slowly started saving. It’s crazy to think that $60,000 covered the 20% down payment, and then some only 25 years ago in Toronto!

5. Do you have any regrets about when you got into the real estate market?

Sometimes we wish we had bought something more extensive, but back then, no one had any idea that housing prices would behave as they have. At the same time, being conservative suited our personalities, and when we bought, dad was still a student. So we took a chance that dad would be able to find an academic job in the city. Luckily he did find a professorship right after he graduated. Although other families in the area eventually upgraded their homes, we were happy to stay put as we liked the location and the size fit our three-person family. We also loved the idea of paying off our mortgage soon and putting away more money in savings for retirement, our family, and our travels.

6. Did you ever get life insurance? If so, when?

When we first bought our house, we got mortgage insurance on my life while dad was still in school. That way, if something happened to me, the mortgage would be paid off. Once dad got a job, we both had small life insurance plans with work. We decided against toping up this coverage. Life insurance can be expensive, so you need to evaluate each particular situation. We felt that we could support our family on only one income if something happened to the other. If something happened to both of us, we felt that the equity in our home coupled with our investments would support Sarah (daughter).

7. Why did you retire when you did? Do you regret not retiring earlier?

I retired at 60, which is a little younger than the average Canadian today. I chose that time because my company had a share pension plan where eligibility began at 60. I always enjoyed my job and the people I worked with. I had a good work-life balance, so I didn’t mind sticking it out. It also matched up well with dad’s retirement. After that, I felt that we had adequate money to lead the lifestyle we both desired. Due to the pandemic, my first year of retirement hasn’t been what I expected, but I’m lucky to have close family and hobbies to keep me busy. So far, I’m not missing work in the slightest!

8. Was it hard being a woman in finance?

It surprisingly wasn’t, at least based on my experience. Although the media portrays equity traders in a male-dominated way, it was all female when I started in my trading department. I worked on the buy-side of trading, and when I started, I think trading was seen as having an administrative component at which women excelled. Although most of us had degrees, few had a finance background or other credentials like their CFA. As I moved up, everyone was very supportive, and I never felt like I had to fight to belong. I’m grateful for that.

This interview was so fun for me, as it felt like I got to know my mom a little more. Although money talk can often be stressful in families, I would highly recommend having similar conversations with your loved ones, no matter how small. You’ll never know what you uncover!

The post How One Mom Managed Her Money in the Early 2000s appeared first on Mixed Up Money.

]]>The post What Are the Differences Between an Unplanned and Planned Pregnancy? appeared first on Mixed Up Money.

]]>you do not get to tell other people how to feel about having or not having children

Having children is quite possibly one of the most stressful journeys’ any couple can face. With so many unknowns, pressure and fears, it’s been my life motto never to ask people about their plans for the future unless they welcome the conversation first.

I’ve seen first-hand the side effects of having no children and feeling pressure to start trying from outside influence. Plus, the results of having one child and still feeling like people aren’t satisfied with our decision. Which, as you’re reading this, I’m sure you can see how ridiculous that sounds. How can anyone else get to feel any way about your body and your lifestyle choices? Yet, this is still how society treats people (women) when it comes to childbirth.

After our first, we were adamant with all of our friends and family that we were a one-and-done type of family. We didn’t want to feel the pressure of adding another child to the mix while still attempting to grasp having a newborn or toddler running around. Adding another person to your life — particularly one you are responsible for — is a significant life change. People bug and ask others when they plan to have their next without realizing that it’s an unnecessary and, frankly, disrespectful thing to ask.

To end those conversations, we would immediately say “we aren’t” to quickly prepare for the counterargument using more inappropriate questions. Many would insinuate that having an only child wasn’t a good idea or that we would change our minds.

Reminder: you do not get to tell other people how to feel about having or not having children.

We’ve never thought about traditional milestones throughout our decade-long relationship until they’ve come up in conversations we have between just the two of us. So, when we started to talk about having a second child (in private) in December 2020, and it seemed we were both on the same page, we opted to give it a shot. If it happened, we’d be thrilled. If it didn’t, we would be okay with that, too. Surely enough, within one month, we found out we were expecting our second. Again, it happened fast, but this time, it was our choice. And for that reason, I felt excitement rather than anxiety.

How did an unplanned pregnancy affect my life — financially and otherwise?

Finding out that I was pregnant in 2017 was not in my plans, and it certainly wasn’t a moment of pure joy like the commercials make it seem. Instead, for most of the pregnancy, I existed in a constant state of panic. If I wasn’t worried about the financial aspect of parenthood, I was concerned about who I’d become as a mother and whether I was meant for that role.

My unplanned pregnancy came with many feelings:

-

A lack of control

-

Constant anxiety

-

Financial worry

I finally felt like I was on a roll with my money, and then suddenly, I had to throw my current savings plan out the window. Before I knew it, we were building a spreadsheet to estimate our cost of living with a baby and also how much we’d need to save for maternity leave.

But, instead of panic, I took control of what I could. Strangely enough, what felt like the most optimistic part of this experience was that I was aware of how to create a budget. I knew where we could cut back and how we could increase our income in the short term because these are all things that I had dealt with before. So, financially, although petrified, I was able to make that part of the situation work, leaving me with enough space to focus on my mental health.

If you’re in my shoes, you can walk through exactly what we did as a couple to prepare for our first child financially:

Becoming a mom was never my intention in life. But after giving myself space and time to embrace the newer parts of my life and what had changed, I felt at peace.

Why did we decide to have a second child?

When it came to our family and the many significant changes we experienced as a duo turned trio, one thing that we loved was that we were getting the opportunity to see life through another human’s eyes. We were getting to teach, learn, and share the things that we love with another person who shared our genetics, and that is a very incredible feeling. So, most of the decisions that lead to us growing our family by one more were emotional.

#1. We knew our daughter would be a fantastic sibling

Our child is extremely outgoing and loving. Both my partner and I are introverts. So, we know that being able to provide her with a best friend (fingers crossed) that she can share childhood and adulthood is important. We also realize that although we are a tight-knit unit now, we can continue that bond with one more, as there is plenty of room left in our home and our hearts for a second baby. Both my husband and I have siblings that we love and we know the value of having those relationships can be irreplaceable.

#2. We were ready to take on the challenge of parenthood in a more composed manner

This time around, I want to give myself a chance to enjoy the early stages of parenting, that I was too anxious and stressed to experience. I want to be myself this time, instead of trying to be what a “mom” looks like on the outside.

#3. Getting to enjoy family holidays was suddenly fun again

Each time a holiday comes around when you are surrounded by kids is something straight out of a storybook. For the first time, I felt excitement through the eyes of a child and it’s a moment that I simply cannot explain. My daughter has made me fall in love with parts of my childhood that I didn’t quite appreciate as much as I do now.

#4. Our life already felt full of adventure, excitement and joy — and we knew it could only get better

We are looking forward to the next 30 years of growth, learning and adventure with two young humans who are experiencing life for the first time.

How does my planned pregnancy differ from my first?

This time around, pregnancy is undeniably different. First off, I was mentally prepared for how my body would change. I knew what to expect, I knew it would change my life, and I knew that it might not always be fun — and I was okay with that. When you go from doing something without feeling like you were ready to knowing that it’s exactly what you want, it’s obvious how much more confident you may be with that choice.

Instead of feeling like I had no control, I felt like I had all the control. Instead of feeling anxious, I’d say I’m almost too relaxed this time around. And financially — we are ready for a rumble and a bit of risk. Although we can estimate how much we’ll spend, and we don’t have to buy as much stuff, we will be living with less during my maternity leave this time around. For that reason, we have doubled our initial savings goal. Ultimately, though, I’m thankful to be able to increase our savings and know exactly what to expect, at least for the first year or two.

Lastly, one of the most significant changes from our first child to our second is that we have friends and family five minutes away this time around. With our daughter, the closest relative was a two-hour plane ride — which wasn’t always easy.

I understand entirely whatever people choose to do as far as having children. I’ve written many blog posts about my shaky experience through round one, and to say my mindset has changed would be the understatement of the century.

I went from keeping my pregnancy a secret to publicly stating I’d only be having one child to writing this post — all about how different my perspective is now that I’m a parent to a three-year-old. The bottom line is that all of these decisions are my decisions — not yours. And the same goes for anyone else who plans to have no children or twenty children.

You are the only person who gets a say in how you feel about parenthood.

The post What Are the Differences Between an Unplanned and Planned Pregnancy? appeared first on Mixed Up Money.

]]>The post Do You Need Life Insurance? appeared first on Mixed Up Money.

]]>Relieving a financial burden can be the best way to take care of loved ones.

It’s challenging to comprehend the more difficult parts of life. And although it’s difficult for me to choose what I’m going to eat for dinner every single night for the rest of my life, the decisions I’m referring to today are a bit more serious.

I’m talking about what happens if we unexpectedly pass or lose a loved one. Okay, okay, please don’t exit or go to another post on my site. I’m telling you right now that this is a necessity. Before I get into the why’s and the how’s — you need to know the should’s. You should have life insurance, especially if you are a parent, or take care of a loved one who couldn’t survive without your financial support.

Read: How To Make An Online Will in Canada

What is life insurance?

Before telling you that you should have a specific type of insurance, it would be valuable for you to know exactly what life insurance is and how it can benefit you financially.

Life insurance is similar to home insurance or car insurance in that you sign a deal between yourself and a company. You will make a monthly or annual premium payment that keeps the contract valid. In exchange for your payment, your life insurance provider will agree to pay a sum of money (or a death benefit) to your beneficiaries (your children or loved ones) upon your death.

In simple and more ironic terms, life insurance covers anyone you leave behind once you die. Very romantic, I know.

Why is life insurance so important?

The benefits of life insurance can be limitless, depending on your situation. If you are a parent, own a business, or leave any loved one behind when you pass away, you’ll want to do whatever you can to support them without being around to support them physically. Relieving a financial burden can be the best possible way to take care of friends and family after you die.

Who should get life insurance?

Now that we know what life insurance is and why it’s so important, you’re probably still asking yourself: is this really for me? So here are a few questions to ask yourself to determine whether you need life insurance?

-

Do I have any dependents? Kids or pets?

-

Am I married, and do my partner and I have a lot of shared expenses?

-

Do I (or will I need to) support my parents financially?

-

Do I own a business?

-

Is my career or line of work risky?

-

Do I put myself at risk more than the average person?

If you answer yes to any of these questions, life insurance is probably a great idea. But, if you’re unsure, you can find out from the professionals.

Where can I get life insurance?

One great Canadian option is PolicyMe. You can find out if you need life insurance by taking their two-minute quiz. It’s nice because it’s no commitment until you know!

The best part about PolicyMe is that you can complete the process 100% online. Most applicants will be approved instantly right after they submit their applications. That means most users won’t need a medical exam.

The week after I had my daughter, I immediately went to their site. I opted for a 10-year plan with $300,000 of coverage, and the relief I felt was incredible. For less than $15 a month, I knew that my family would be okay if anything unexpected happened to me.

What types of life insurance exist, and which one is for me?

Some great questions that many people will consider when deciding whether they need life insurance are what type of insurance, how long they should get coverage for, and what amount they’ll need.

There are two types of life insurance that you can choose between. First, there is term life insurance. This is fixed-term, usually between 10 to 30 years. It’s more affordable because you carry a lower risk of death and are typically younger and in better health.

The second option is permanent (or whole) life insurance which guarantees coverage throughout your life. Although this may sound more appealing, it can be very costly. Typically, whole life insurance acts as an investment vehicle as you can borrow or pull money out of this policy. But, again, it’s an expensive way to save for your retirement. It’s better to max out your retirement account each year than to purchase whole life insurance.

On average, whole life insurance can cost nearly 10 to 18 times more than term insurance coverage. As you age, whole life insurance premiums increase, which means you may not be able to afford this amount, and you could risk running out of coverage regardless of being led to believe that it’s permanent.

If you’re unsure which option is best for you, speak to an insurance professional — or directly to a PolicyMe advisor. They are non-commissioned, so your best interest is in their mind always. They are available by phone: +1 (866) 999-7457 or email: [email protected]

As far as coverage goes, some good considerations include:

-

Your age

-

Your dependents age(s)

-

Your current savings and liabilities (debts)

-

How much income your family needs to cover their expenses each year

If you’re still unsure, it’s never a bad idea to see what your options are and take the two-minute quiz to confirm whether or not you even need life insurance or how much it may cost. Just remember — the longer you wait, the higher the price tag could be.

The post Do You Need Life Insurance? appeared first on Mixed Up Money.

]]>The post How We Planned our Dream Wedding for Less Than $20,000 appeared first on Mixed Up Money.

]]>It was just what we imagined. Only better.

Planning a wedding on a budget might not scream a ‘dream event,’ but for me, finding a way to start life married to my partner meant keeping costs as manageable as possible while still enjoying our big day.

It should now be apparent that I am married, and therefore, officially off the market. Sorry to disappoint you all, but this year marks our fifth wedding anniversary, and things are still looking pretty good.

In 2016, my husband and I paid for our entire wedding by saving heavily over six months and by slowly paying off more oversized items as we inched closer and closer towards our wedding date.

Holding zero debt after the one life event that most couples struggle with was extremely important to us. We wanted to enter our marriage with a clean slate and clear VISA.

Before I go any further, I’m sure most people reading a personal finance blog may expect a modest and below-average budget. And, while it’s true that we are definitely below the average $40,000 wedding. It doesn’t mean we could spend just $5,000 and still have all that we wanted.

Both of us wanted to be able to spend a weekend away with our closest friends and family while allowing them to spend a minimal amount of money. As most of our best friends at the time were still in post-secondary or just graduated, we found it unfair to ask them to shell out for a destination wedding or a $500/night hotel room.

Where did we get married?

We chose to get married in Canmore, Alberta. Canmore is a beautiful town with mountain scenery – but it can also come with a hefty price tag during the summer months). However, we were smart-ish. The two of us chose this beautiful bed & breakfast to host our wedding weekend. We could rent out the entire facility from Thursday to Sunday and charge our guests whatever we felt was appropriate. Not only was breakfast a built-in part of the cost, but there were also more than enough rooms to sleep all 36 of our guests comfortably.

We asked our guests to pay $200 per person for their room, food, and alcohol for the entire weekend.

What was our wedding schedule?

Our weekend began on Thursday night, with a movie night for the wedding party and immediate family. On Friday, we had a small ceremony with only our wedding party and immediate family, and that evening, our remaining guests arrived for dinner and intimate reception.

To celebrate being a responsible and mature married couple, Saturday was a kickball game to determine which one of us would be the superior person in the relationship (I won) and an afternoon full of drinking games. Lastly, we enjoyed a Sunday morning goodbye brunch and thanked all of our friends and family for making our weekend as perfect as could be.

It was just what we imagined. Only better.

What made us even happier than all of the memories we shared during that special time was that we came in under budget.

*skies part, angels sing*.

Because, you know, we care about our finances.

What did we spend?

The first thing we did when we got engaged was sit down and put together our guest list. We wanted to see our starting point and make sure that we were on the same page.

The list quickly grew to over 100 people, and I started to feel overwhelmed. At that point, the thought of eloping was number one in my mind. Not only would it be cost-effective, but the fewer people staring at me as I walked down an aisle, the better.

My husband wasn’t exactly on board, so instead, we chose to do a very intimate wedding day that would cut down on the cost of the more typically expensive budget items, such as dinner and drinks.

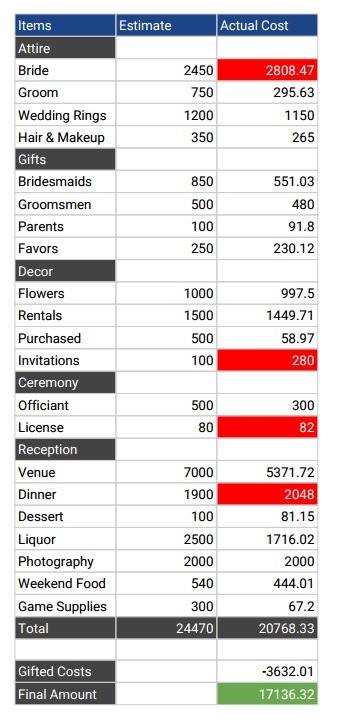

Our estimated budget came out to just over $20,000 – but in an ideal world, we wanted the total to be less. Before gifts from parents, our total cost of the big day was $20,768. After the gifted portion of our wedding, we spent $17,136.

Not only was our final wedding cost over $7,000 under our original estimation, but we also ended up breaking even after receiving wedding gifts. For us, it feels like we saved all of this money, took it out to admire our hard work, and then put it back in the account like nothing ever happened. Success!

What did our budget look like?

Now – for those who inspect my budget – perhaps currently judging, laughing, and choking at some of the numbers, I feel like this is my chance to defend or agree with all that you’re thinking.

How did we swing a smaller guest list?

The number one question we always get asked is how we managed to keep our guest list so small, and the final decisions we made to keep our list within reason were two-fold.

#1. We chose not to invite any extended family

While this wasn’t an easy decision, and most people don’t feel like they have this choice, we stood by the fact that this was our wedding, and fortunately, most of our family was understanding. It’s never easy to pick and choose family members, and because we felt it would be unfair to invite some and not others, it only made sense for us to keep it simple.

#2. All guests outside of immediate family needed to be mutual friends

This decision wasn’t easy. But, aside from our wedding party, which had five of our best friends on either side, any additional wedding guests we invited needed to be mutual friends. Not only did that make the day easier to celebrate because we knew everyone would get along, but it also narrowed down our list to get under 40 people.

We also told our best friends six months in advance that they would not have a plus one if they were not currently dating someone. I appreciate my friends for not thinking I’m a meany.

Although this doesn’t always work for everyone, I am the type of person that doesn’t ever expect an invitation to any event or wedding my friends and family host. Therefore, we hoped others would understand. Luckily, nearly everyone in our life did. And to this day, there are only two people we had at our wedding that we no longer speak to, so I’ll call that a win!

Let’s break down some of my expenses

#1. Attire

When it comes to a wedding dress, it’s not always easy to determine an appropriate budget. It’s true; I busted my budget on a wedding dress and jewelry that I’ll never wear again. At the time, my 18-year old self would have said, “don’t question it, girl, the photos say it all,” but my 26-year old self said, “you idiot.” Especially considering that at about 10:45 on my wedding night, I got way too low during Baby Got Back and busted the “back” wide open (#onlyme).

But, now, five years later, I’m still thrilled with each of my expenses, including the $2,000 piece of fabric that now sits in my closet untouched.

On the flip side, my partner killed his attire budget, got a suit on sale online, and did not need any alterations! Oh, to be a dude. As for the rest, I blame beauty magazines and Pinterest.

#2. Gifts

Gifts are an interesting wedding expense for many reasons. It’s difficult to determine how to appreciate guests that go out of their way to spend money on a day that is all about two people outside of themselves. We ask so much of our wedding guests, family members and wedding parties, so finding the right way to help them out is essential.

After a beautiful bachelorette weekend, a lovely and intimate bridal shower and many text message conversations about bridesmaid attire – to which they each purchased their chosen outfit, it was necessary to buy my girls a gift.

We decided to purchase pants and ties as a gift for the groomsmen so that they did not have to worry about finding clothing and asked that they bought a white button-up shirt if they didn’t have one on hand.

Lastly, we took our parents for a lovely champagne lunch as a gift, and our wedding favours were homemade tie-dye jerseys for the Saturday kickball event. Flashy, right?

#3. Decor

Thankfully, the bed and breakfast we got married in was beautiful enough without too many additional materials. Rentals included all of the table cloths, speakers, projector, chair covers, and beyond. Invitations were over budget because initially, I would make my own, cutting down the design costs and printing, but my laziness won out, and we ordered through Minted.

As far as flowers, I’m not picky, so I believe my exact words to the florist were “whatever would look best and was within my budget.” Each of my bridesmaids received a flower crown and small bouquet. I got a lovely bouquet myself, and then for the rest of the reception, I ordered a bucket of flowers for $200.

#4. The rest

The venue was the cost of the bed & breakfast in its entirety. Yes, for the whole weekend. Yes, for the setup and takedown of each event. Luckily for us, we were the first wedding the bed and breakfast had hosted since purchasing the renovating the location, which meant that we were fortunate enough to score a fantastic deal.

We were over budget on dinner because we opted for a sit-down instead of a buffet, which was the better option in my opinion. Dessert was donuts from Modern Jelly, and my lovely professional pastry chef friend from Calgary made & gifted us an incredible crepe cake.

Liquor was another one that we lucked out on, as we have quite a few friends who were able to slide us a deal or two. Thanks to our network, 90% of our booze came in at cost or staff pricing, saving us heaps of money in the long run. Buying liquor for a weekend filled with 36 wine and beer lovers was extremely hard. But we had a lot leftover, which is better than turning up dry. Did I mention it was an open bar?

The “weekend food” included lunches, dinners, and late-night snacks for Thursday to Sunday, and the game supplies were merely a permit to use a local field for our kickball game.

*takes a deep breath*

Well, now that I’ve written the longest blog post of my life, and you’re like, “okay, Alyssa, we get it,” I’ll move on.

What did I learn from my wedding planning experience?

In the end, weddings are expensive no matter which way you spin them. If a vendor hears the word “married,” you can guarantee the price will increase by a good 30-40%.

So, I learned some important lessons about the process (good and bad)

-

Flexibility will save you money and lots of it

-

The smaller the wedding, the more you can do

-

Let yourself lose control — just this one time

-

Treat your wedding day like any other day to avoid stress and nerves

-

Apple Music, or in my case, a sibling with good taste, makes for a great DJ

-

Know what you want before you put down any deposits

-

People are more generous than you’ll ever understand

-

Don’t worry about inviting everyone you know

-

Your wedding dress doesn’t care how much you love to dance

-

Nothing matters but your genuine love for one another

People told me that the day goes by so fast you won’t even remember it, which is why I spent my time relaxing, never in a rush, and always breathing in the important moments. My day didn’t go by too fast. Instead, it was just right.

There are no right or wrong ways to celebrate your relationship – whether you get married with 200 guests around you or opt to hop over to the courthouse on a Wednesday afternoon. Either way, finding a way to make sense of the cents can make a somewhat stressful event a lot more enjoyable when you know you can actually afford to enjoy every minute.

Before you get married, you need to talk about money!

My course, ‘Oh F*ck, Are We Ready to Talk About Money,’ is perfect for couples to learn how to navigate a typically uncomfortable conversation. You and your partner have experienced enough uncomfortable firsts. So, let’s not put ourselves through that again with our money.

What does the ‘Oh F*ck, Are We Ready to Talk About Money’ course get you?

15 exercises to help you better understand each others’ financial situation

15 exercises to help you better understand each others’ financial situation

A 24-page printable workbook to use as you go through the course

A 24-page printable workbook to use as you go through the course

7 video lessons to guide you through the tougher conversations

7 video lessons to guide you through the tougher conversations

3 goal-setting tactics to help you plan your financial future together

3 goal-setting tactics to help you plan your financial future together

Quiz to help you identify the best way to manage your money

Quiz to help you identify the best way to manage your money

Excel spreadsheet to manage your monthly budget separately or together

Excel spreadsheet to manage your monthly budget separately or together

The post How We Planned our Dream Wedding for Less Than $20,000 appeared first on Mixed Up Money.

]]>The post 5 Financial Mistakes You’re Making in Your Relationship appeared first on Mixed Up Money.

]]>Healthy relationships thrive when both partners contribute to all aspects

Once you leave school and enter your early twenties, relationships become more complicated, and financial decisions involve more than deciding who’s turn it is to order UberEats. Although you may miss the days of zero complexities, mature relationships aren’t all bad. Together, you support each other to reach your goals. With any discussion in a relationship, the key form of attack is honesty and open communication, and the same goes for your finances.

My current boyfriend and I have successfully navigated two rentals, new jobs, property hunting, and a furry friend. Hopefully, I can help you navigate similar financial transitions with what I’ve learned. Below are five mistakes you may be making that are hindering your relationship from being a supportive financial unit.

1. Failing to be transparent about your financial situation

If your childhood was similar to mine, you may have grown up being told that it was rude to talk about money. What was especially forbidden were any questions involving salary or net worth, even between family members. In addition to these well-known rules, there were also unspoken rules. Like how you could never discuss the price of a person’s home, or how both parties had to insist on paying the dinner bill.

With these societal rules ingrained in us from a young age, it’s easy to see why we fall short when discussing money with our romantic partners. Often, it takes years into the relationship before you know the financial baggage that your partner is carrying. Perhaps only when you’ve reached the point where you’re assuming that baggage as well. Maybe you’re keeping quiet for fear of judgment, or maybe you hadn’t thought to be open about finances with your partner yet (which is totally normal, btw).

The foundation of any healthy relationship is honesty and trust, and you should include those same values in discussions about a person’s financial situation. Sit down with your partner and be open about your debt, salary, savings, and everything in between. This will be one of the most important conversations that you navigate and will be a key milestone in your couples’ history.

My boyfriend and I discussed our financial situations pretty early on due to our circumstances. After graduating from university, we were moving into an apartment and had to discuss our rental budget and lifestyle expectations. Both of us were in a very fortunate situation because we didn’t have any student loan debt; however, I didn’t have a stable job lined up after graduation and was worried about my future income. Knowing that my boyfriend supported me emotionally and was willing to support me financially, if needed, made that transition in our lives much easier.

2. Not including your partner in financial decisions

No matter what stage of your relationship, you should do your best to include each other in all financial decision-making. But when it comes to newer relationships, there can sometimes be a grey area. Maybe you’ve never included each other in financial decisions before, and you’re not sure whether now is the right time, or worse, if your partner will care.

If you’re happy and want your partner to feel secure in the relationship, I suggest that you share, share, share. Even if it doesn’t directly affect your partner or if the decision is ultimately yours to make. Without open communication, your partner could be caught off guard and question your commitment to the relationship moving forward. They will appreciate the open communication and that you cared to listen to their point of view. And if you do see a future with them, any financial decisions you make will ultimately affect them, so you want to make sure they’re understanding.

About a year into our relationship, my boyfriend made it clear that he was interested in buying a house. His family was in the business and didn’t view renting as a good option. Although he knew that I was not interested in investing with him, he communicated with me every step of the way. He took my opinions into accounts, such as location and interior design, as I would ultimately be living there too if things continued. Although his investment didn’t directly affect my finances at that point in our relationship, it was still really nice to be included in the decision-making and made us stronger because of it.

3. Avoiding talking about “the future”

I understand that new relationships are meant to be spontaneous, fun, and taken day-by-day. Trust me, I’ve been there, and I get it! When I say discussing the future, I don’t mean picking out your baby names. What I mean is discussing your five-year (or more) plan. If you see yourself staying with your partner, you should have an open dialogue about your goals and ambitions.

It’s easy when you live in the same town or go to the same school, but once you leave university and enter the “real world,” I feel that everyone is constantly moving in a million different directions. Do you have any plans to travel? Work abroad? Move to the city? Move out of the city? These are all important conversations worth having. Not only that, but each of them directly correlates to money.

Discussing these things ahead of time will allow both of you to decide if your plans align and how to implement them properly. Nowadays, you can’t drop everything to travel through Europe busking on the streets (something my dad has, in fact, done). Spontaneity is hard to come by, especially with two people, if you don’t want to run into financial problems. If I ever get to travel again post-COVID *sigh*, I know that I’ll do something similar to what my parents did in their twenties. After university, they returned to their hometowns to work and save money. From there, they were able to coordinate work, living situations, and travel expectations. Although they weren’t known for luxurious travel, they had enough money to enjoy themselves while not running into future debt.

4. Adopting a “breadwinner” mentality

Although it may seem old-fashioned and 50’s housewife-esque, subconsciously, the concept of a “breadwinner” within a relationship may still be present. The breadwinner is the sole income provider, and in a relationship with dual income, the breadwinner is the one who earns more. Whether unconscious or not, the idea that you or your partner are the “breadwinner” has a variety of negative connotations that can affect your relationship. If you haven’t already, go check out Alyssa’s recent article here, where she goes in-depth on the history of the term “breadwinner” and how it no longer serves.

Using breadwinner titles immediately brings inequality within a relationship. Healthy relationships thrive when both partners contribute to all aspects – childcare (if needed), housework, quality time, emotional support, etc. With a breadwinner, there is the assumption that they are no longer responsible for contributing to these other, equally important, aspects of a relationship. This title may also influence the holder to have more control over their partner. Subconsciously, you may view your opinions as superior, contribute more to decision-making, and only provide money to your partner for things you see fit.

Through Alyssa’s research, she surprisingly found that women who were the higher earner of the household were actually less happy than women who were not. This was because, on top of the career stress, they were supporting their families to the same extent.

The bottom line is, don’t view yourself as superior if you earn more, and don’t view yourself as inferior if you earn less or nothing at all. A healthy relationship is a cohesive unit that requires all areas of support to function.

5. Not spending money on experiences together

This one may seem counterintuitive but let me explain. A healthy financial relationship is balanced. Balanced between saving for your future together and spending money on your present selves. I think those who are well-versed in the financial space tend to be wary of the latter. It’s easy to feel that way when interest rates and compounding periods are swirling around in your head. But, if you’re avoiding leaving the house because you don’t want to spend any money, your relationship will suffer.

I’m not talking about spending money on materialistic things. I’m talking about experiences. I realize that not everyone (including me) can afford to go on fancy vacations or see big concerts. I’m talking about going to the movies, a new restaurant, or bowling! Whatever activity you and your partner enjoy doing together. (These suggestions are obviously in a Post-Covid world). I realize not everyone has the luxury of spending money on activities. Still, if you are financially able, I highly recommend setting aside money in a ‘date budget’ for these things. That way, you’re still able to make those memories with your partner while not jeopardizing your future.

When my boyfriend was considering investing in the house, I was a little worried that we’d have no money left for each other. I still wanted to go on weekend trips, go out to eat and drink, and travel once all of this COVID craziness died down. He assured me that the mortgage payments would not affect our experience budget, which made me feel much better about the potential decision.

As we all know, money is a taboo topic – more so than sex or even death at times. It’s hard to go from society keeping us so secretive, to openly having discussions with people that you love. There is no such thing as perfection, but just know that any money conversation is better than none.

Mixed Up Money is thrilled to share that the digital workbook and spreadsheet from the ‘Oh F*ck, Are We Ready to Talk About Money?’ couples course is now available as an individual product at a reduced price made more affordable for couples.

46% of couples agree money is their biggest challenge in the relationship. Imagine planning a wedding with your partner that ends in a fight because no one is willing to compromise their idea of a good budget. And then having this same argument over every little money issue, ever. Not fun!

With this download, you will:

-

Find a way to communicate about money effectively

-

Learn about the emotional side of a dollar

-

Get to know all of the details you’re too uncomfortable to ask

-

Tackle questions that help you and your partner understand your money stressors

-

Focus on setting ground rules so that both of you feel heard

-

Learn the best way to manage your finances as a team

-

Have access to an Excel spreadsheet to manage your monthly budget separately or together

This is a digital download that includes a 24-page printable workbook to help you and your partner get to know each other on a deeper level – as in financially. Once you purchase your workbook, you will receive a download link for a zip file that includes the two PDF files and one Excel spreadsheet. One PDF is a printable version of the workbook, and the other is a fillable PDF to complete on your desktop. You will have 24 hours post-purchase to download the file as digital prints are for personal use and not for resale, or to be shared with friends.

To access the full course and video-sessions, head here.

The post 5 Financial Mistakes You’re Making in Your Relationship appeared first on Mixed Up Money.

]]>The post Why the Term ‘Breadwinner’ Doesn’t Fly Anymore appeared first on Mixed Up Money.

]]>

no one person in a relationship is responsible for one area of livelihood

If you’re in a committed relationship, there is a high chance that one of you earns more income over the other. Statistically, if you are in a hetero-CIS relationship, the male is the one who makes the most money. Payscale did a study and found that as of 2020, women earn only $0.81 for every dollar a man makes.

This statistic, of course, doesn’t specify the differences for women of colour. But the Institute for Women’s Policy Research (IWPR) found that if the gender wage gap doesn’t change and continues to move at its current pace, it will be 40 years until white women earn equal to their male counterparts. For Black women, it’s 111 years, and for Latinx women, equal pay is 205 years away.

It’s essential we also note that sexual orientation wage gaps also exist – although some data shows that gay men and lesbians outearn their straight counterparts. Ultimately, each of these numbers proves how blatantly obvious discrepancies in relationships can be.

So, what is a breadwinner?

The term we historically used to describe the higher earner in a relationship or the sole-income provider is a breadwinner. Because the breadwinner contributes most of the household income, people see them as the primary financial support for the family’s livelihood. It, of course, makes sense.

If you bring home the money to cover household expenses, you are likely to pay for the bread. Most often, we use this term in single-income households. But in dual-income homes, this term would mean that the breadwinner has a more stable income, whereas the other earner would be able to afford to leave the workforce because their position is less critical.

You see, this is where things get a little bit ambiguous for me.

In a 2019 Institute for Family Studies (ISF), 25% of women are the primary breadwinner. For Black women, 35% outearn their husbands. Of course, the number dips by about 3% if there are children in the house because women typically take parental leave and lose income and earning potential long-term.

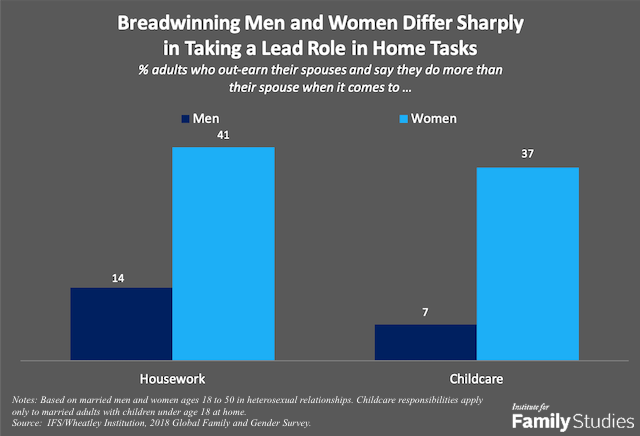

For women who are the breadwinner in their household, childcare and household chore responsibilities are much higher than men, even with the increased stress of providing financial support to their family.

The shocking part is that even though women are doing well with their careers and outearning their partner to provide stability for their families, they are 55% less likely to be happy than women who are not the breadwinner. Why? According to Pew Research, an equal share of chores around the house means more to a partner than income.

So, why is calling someone a breadwinner problematic?

Although the term breadwinner doesn’t seem to have a negative connotation, it can be frustrating that by earning the higher or sole income in your household, you are automatically in control of the decisions made. It’s also an assumption that you are not responsible for contributing to the relationship in other areas of your life because you earn more.

You see, having a significant other can be highly beneficial for your financial situation. After all, it’s relatively straightforward that having dual-incomes means that you earn more money. The caveat being that the only way a partnership can stay successful financially is if you consider one another as equals.

To achieve financial equity in a relationship, you can not use money as a weapon. One person does not control your needs and wants. Instead, you work together to share the burden of choosing what you spend — regardless of the discrepancy in earnings.

The more traditional way we use money in households makes men feel as though they need to be the higher earner for their family, and if they don’t, they aren’t enough of a man. But, that same ISF study found that “life satisfaction does not differ significantly among married men, whether they are the primary breadwinner or not.”

How do you talk about money in a relationship?

My course, ‘Oh F*ck, Are We Ready to Talk About Money,’ is perfect for couples to learn how to navigate a typically uncomfortable conversation. You and your partner have experienced enough uncomfortable firsts. So, let’s not put ourselves through that again with our money.

What does the ‘Oh F*ck, Are We Ready to Talk About Money’ course get you?

15 exercises to help you better understand each others’ financial situation

15 exercises to help you better understand each others’ financial situation

A 24-page printable workbook to use as you go through the course

A 24-page printable workbook to use as you go through the course

7 video lessons to guide you through the tougher conversations

7 video lessons to guide you through the tougher conversations

3 goal-setting tactics to help you plan your financial future together

3 goal-setting tactics to help you plan your financial future together

Quiz to help you identify the best way to manage your money

Quiz to help you identify the best way to manage your money

Excel spreadsheet to manage your monthly budget separately or together

Excel spreadsheet to manage your monthly budget separately or together

Money is not the only way you provide support to your family. It’s ONE of the ways you give support to your family. And although this isn’t always easy to understand, it’s time we learn.

The post Why the Term ‘Breadwinner’ Doesn’t Fly Anymore appeared first on Mixed Up Money.

]]>The post The Ultimate Guide to RESPs for New Parents appeared first on Mixed Up Money.

]]>

However much you choose to save for your child’s education is a personal choice

The day your baby arrives in the world, the last thing on your mind is all of the underlying responsibilities that take place, aside from keeping them alive. I’ll never forget when the doctor came in just 24 hours after my daughter’s birth and told my husband and me that they’d discharge us shortly, mostly because the conversation was followed by being handed 30+ documents that we needed to fill out and sign.

Naming your kid, signing up for government benefits, issuing a social insurance number (SIN), what vaccinations she needs and when. To say it was overwhelming is likely the understatement of the century. Not to mention, after coming down off the painkillers, it’s highly likely that I made at least three mistakes on each piece of paperwork.

Before my daughter was born, I did make sure to write a checklist of essential tasks I’d need to accomplish the month or two after she arrived. I needed to add her to our online will, assign her as a beneficiary on all of my work documents, and of course, open a Registered Education Savings Plan (RESP).

That’s right. I was already thinking about my child’s education while still in the womb, and perhaps it’s good that you do, too.

What is a Registered Education Savings Plan (RESP)?

An RESP is a savings account for your kid’s post-secondary education, should they choose to pursue college or university. As the child’s parent or relative, you can contribute to the account on their behalf as soon as they have a SIN.

An RESP is registered through the Canada Revenue Agency (CRA) and similarly has limits to your Registered Retirement Savings Plan (RRSP) or Tax Free Savings Account (TFSA). One significant difference, though, is that there are no annual limits for contributing to your RESP. Instead, the maximum lifetime contribution a beneficiary (your child) can receive is $50,000.

Already honestly so sorry about all the acronyms.

One of the great things about an RESP is that some accounts are eligible for government grants. Yay!

The available grants are:

-

And potentially any education savings programs in your province

If you receive any additional funding from these grants, please note that the extra contributions made by the government do not count towards your $50,000-lifetime limit. As long as the money you contribute towards your education fund stays in the account, it is not taxable, just like an RRSP.

Where can I open an RESP?

Choosing a provider for your RESP is similar to selecting any financial institution for your money or investments. You must take time to do research and make yourself aware of any associated fees or contribution limits. Nearly every bank, credit union and investment company provides RESP options.

Before you choose your financial institution, you’ll need to know the different types of plans you can choose for your RESP. There are three options, including a family plan, an individual plan, or a group plan. To clear up the inevitable confusion this has now caused, here are the main differences between these plans:

-

Family plans are ideal for families with more than one kid. If you have a family plan, the contributions made to your RESP can be used for any related child you have (including your kid or your grandkids).

-

An individual plan is ideal for people who are not related to the beneficiary of the RESP. Keep in mind that if your best friend were to open an RESP for your kid, as well as yourself, the limit for the beneficiary is still $50,000.

-

Lastly, a group plan is an investment tool provided by a company rather than a financial institution. Multiple people can contribute to a group plan with regular payments and grants.

Your financial institution or provider should be able to help you choose the best option for you. But, to make sure, here are a few good questions to ask your chosen financial advisor before you make the final decision:

-

Are there any fees associated with the account?

-

Is there a minimum contribution requirement?

-

Will regular contributions be required?

-

What are my investment options?

Investing using your RESP is a great way to help the contributions you make grow using the power of compounding. All you need to open an RESP is your child’s SIN number, your SIN number, and your child’s birth certificate. There is no cost to open an RESP.

What happens to my RESP if my kid chooses not to pursue post-secondary education?

MOM! I told you! I’m not going to college

An RESP can only be open for 35 years maximum, and can no longer accept contributions after 31 years. In other words, if your child isn’t sure if they’d like to attend post-secondary, they have until 35-years-old to make the call.

If your child turns 36 and suddenly says: “MOM! I told you! I’m not going to college,” there are a few options.

-

If you have another, younger child or relative who could use the money, you can transfer funds from one RESP to another.

-

You can transfer the money to an RRSP, give or take a couple of conditions. One, your RESP must be at least ten years old, and two, you must have enough contribution room in your RRSP for that tax year.

-

You are free to close the plan and receive your contributions back. In this situation, though, you’ll need to consider the conditions yet again. One, you will have first to return any of the money received via those government grants we talked about. And two, you’ll have to pay taxes on any investment earnings you gained through the RESP.

How much should I try to save for my child’s college tuition?

If you’ve read all of this information and all you can think about is the fact that

-

$50,000 is a lot of money, or;

-

$50,000 is not enough for a post-secondary education

I completely understand these concerns.

If you’re curious about what a good goal is, and want to have a better understanding of what you should save in total for your child’s future, a good rule of thumb is to take inflation into account. Currently, the average cost of a four-year university program in Canada is $25,852. Let’s look at an example.

If your child is one-years-old in 2020, and we use an average inflation rate of 2.5% per year, in 2038 and on their 18th birthday, the average cost of a four-year university program could be about $39,335. Although, that number doesn’t include housing, transportation or books.

Therefore, to cover tuition only, you’d need to save around $2,185 each year if you didn’t invest that money or receive any grants.

Investing alone can be a significant help to maximize your RESP earnings. Using a simple compound interest calculator, I found the following numbers:

“Your initial investment of $2,000.00 plus your yearly investment of $1,500.00 at an annualized interest rate of 5% will be worth $47,568.96 after 18 years when compounded monthly.”

Then, if you are to add in the CESG grant, for example, your annual contributions between $500 and $2,500 will be matched at the rate of 20%. The maximum CESG lifetime allowance is $7,200 per child.

How is my RESP set up?

I use Wealthsimple for my child’s RESP. I chose this platform because I already have investments, the fees are low, and my husband and I can make automatic contributions and monitor the account. One of my favourite parts about Wealthsimple is the ability to see how much money you’ll earn over the period you plan to save, which can help you adjust the numbers to reach that goal.

Wherever you choose to keep your child’s RESP, just remember to ask questions to ensure you aren’t paying fees you shouldn’t be, and that you trust the institution you choose. Do your best to invest the money in a way that suits your risk profile, and don’t forget to take advantage of any government grants that are available to you based on your annual income.

However much you choose to save for your child’s education is a personal choice, and there are no end-all, be-all numbers that make one parent better. Any savings is a fantastic investment for your child, whether in their college fund or to keep them healthy and fed throughout their lives.

The post The Ultimate Guide to RESPs for New Parents appeared first on Mixed Up Money.

]]>

(@mixedupmoney)

(@mixedupmoney)